So I made a few phone calls today. Couldn’t get anyone at Penske to answer the phone so I decided to try later and call the railroad company. I was told the driver had to be on the approved list so I inquired as to how to do that. Wow! So this is a CSX approved driver list. This is a whole transportation thing. The shipping container is owned by Hapag-Lloyd. The chassis (container trailer) is owned by another company which may or may not be the railroad company. So in order for all these things to be used interchangeably and transported to and left in other states or even countries the owners of these assets have to be able to track their location. But for a trucking company to move a container they have to provide proof of insurance to the owner of the container as well as proof to the owner of the chassis. That’s what this system is. Any trucking, railroad, or container ship company registers their company, drivers, and most importantly insurance information with this system. So, I’d need to get a DOT number for my company, trucking insurance for my company, and pay for the annual fee in order to pickup the container myself. So I’ll have to hire a trucking company that’s already registered to transport the contafrom the rail yard to the workshop.

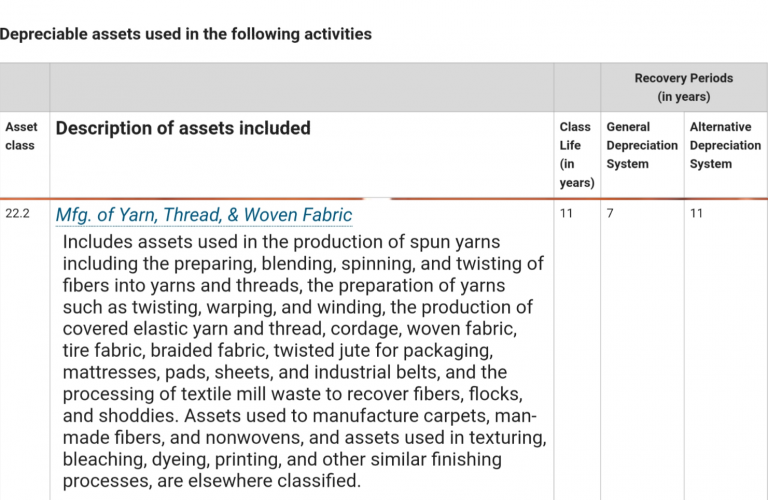

When you purchase a fixed asset for a company like a rope machine it isn’t considered an expense. The company had $24,000 in cash then it had $12,000 in cash and $12,000 in equipment. The company is worth $24,000 either way. But equipment loses value over time. As the machine is used it starts to wear and it can’t be sold for as much as it was purchased for. That’s called depreciation. In that charts above are the depreciation classes and schedules for the rope machine. Each year over 7 years I get to depreciate the machine as an expense to the company. The first year (this year) I can depreciate 25% of the total cost to purchase and setup the machine. That includes things like transportation costs, installation costs, and materials needed to make the machine operational. This means for this year whatever profits the company makes is already going to decrease by at least $3000. Since the company isn’t projected to make much profit this year and has to retain all of its earnings to afford a shipment of yarn, this reduces the tax liability of whatever profit would have been realized.

To explain. If the company sells $13,000 in rope this year and has $3000 in expenses then the profit would be $10,000. So the company owners would need to pay taxes for that $10,000. 5% owners would have to pay taxes for $500 which is about $130. But the company cannot distribute any of the profit to the owners since it has to save for yarn. This means each owner is responsible to pay taxes even though none of them collected any money from the business. It’s called phantom income. So through depreciation of the machine the profit is actually only $7000 ($13,000 – $3000 [expenses] – $3000[depreciation]). This reduces the amount of phantom income each owner is responsible for.

This along with the current cash on hand should be enough to purchase yarn which will be about $20,000 with shipping. However, once the machine is operational I may take out a loan to purchase the yarn since it will take at least 6 months to receive the order after payment is sent. This means the company may run out of yarn before the shipment arrives if we wait until we save enough money prior to placing the order. Currently there is only enough yarn in inventory to produce about $8000 in rope. A loan allows us to order sooner and hopefully receive the yarn shipment before the current inventory is depleted. The loan should be repaid rather quickly once the new yarn arrives. With a healthy inventory of yarn and the ability to produce rope much faster we should be able to keep enough rope in stock to allow for an ad campaign and the sales increase it will bring. I’ve held off on direct advertising because I am currently unable to meet the demand that would generate.